The coin market is open 24/7/365 and you can’t always keep an eye on prices or be ready to sell in the event of a large drop. This keeps a lot of people up at night worried that their investment will disappear while they sleep.

The good news is that you can set up stop loss orders to mitigate the risk in the event of a drop in value.

A stop loss order allows you to specify the price at which an order should be executed. This means that you can execute a sale automatically if the price drops to a certain point.

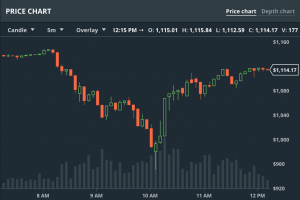

Cryptocurrency prices can fluctuate rapidly

There are two steps in setting up your stop loss strategy using GDAX (now Coinbase Pro). A good stop loss strategy leverages the combination of a stop order and a limit order (creating a stop limit order) to trigger a sale. I’ll start by clarifying those two components to make it easier to understand why we are using them in tandem.

Stop Orders:

A stop order is an order to execute a sale once the coin reaches a certain price.

Limit Orders:

A limit order is an order which buys or sells a coin at a specified price or better. In this case we will be looking to sell coin at your specified limit price or higher. A limit order is not guaranteed to execute since it requires a buyer that is willing to buy at your price or higher.

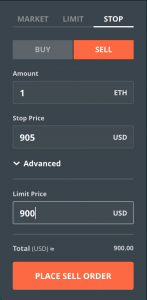

example stop limit order on gdax

As an example let’s say that you have just placed an order for one Ethereum coin at $1000 USD. There will be some normal fluctuations around your sale price, but you are unwilling to accept greater than a 10% loss to your original investment. Therefore in the event that the value of ethereum drops to $900 you want to automatically trigger a sale to recoup at least $900 USD.

After your initial purchase you can set up a stop limit to protect you from a potential catastrophic loss. Keep in mind that this order may never fill, either if the value never dips to $900 (this is what you hope for) or if it drops so quickly that both the stop price and limit price are passed on the way down (this would be bad).

Choose the stop tab, then click the sell button to indicate you want to sell if your stop price is reached. You want to sell your 1 ethereum (amount) for $900 or more (limit price) if the value of ethereum drops below $905 (stop price). To put it another way, a sell order will be placed only in the event that ethereum’s value drops below $905. If that dip occurs and the order is placed, it will be placed as a limit order, putting your coin for sale at or above $900.

Comments 3

I wanted to see if this worked with BTC. Bought at around $9000 and set the Stop price at $8950 and limit price at $8940.

The price went below $8930 at a point of time and bounced back to $9000+ within an hour.

However, the order did not get filled. Where are I going wrong?

Basically your stop and limit prices were too close together so it bounced quickly and never triggered the order

suppose the current price is 8000, i want to sell if it’s below 6000 (to stop loss) or above 10000 (to take profit). is that possible? i will need to set up two stop limit orders, one at 6000 and one at 10000? not sure how “triggering” is defined