Ethereum (ETH) is going par to par with Bitcoin and that is why it has been facing an increasing interest. It currently has a market cap of US $79.2 billion and currently has a trading volume of US $3.18 billion as per the last 24 hours.

What is Ethereum Hashrate?

Hash: Mathematical problem that miners solve.

In the case of Ethereum the mathematical problem is verifying transactions on the blockchain.

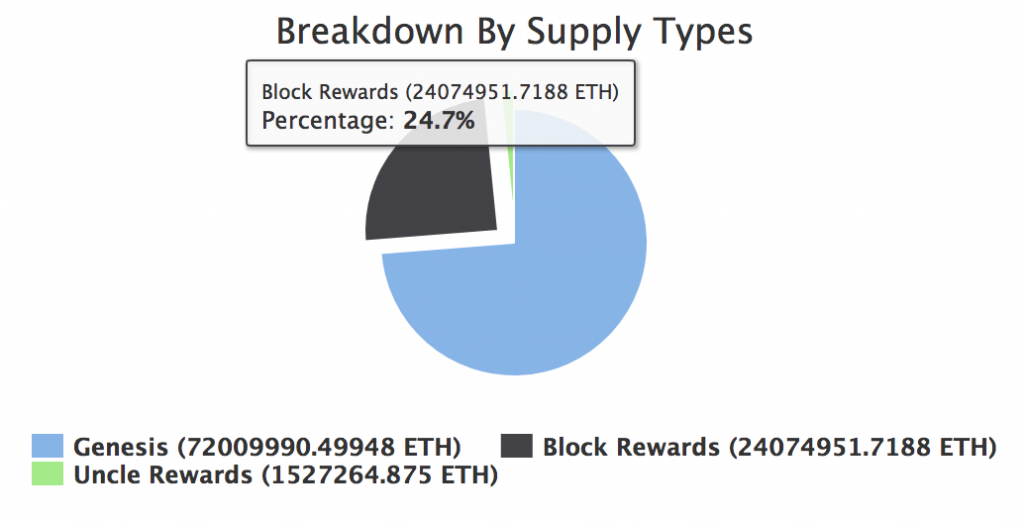

So you can see here about 24% of Ethereum coins are set aside as a block reward for miners.

The hashrate is the calculation of how fast your mining is solving these mathematical problems. The higher the hashrate the faster the miner is solving these problems.

It is not only the hashrate that determines the profitability rate. Even though the hash rate is important, the power consumption ratio is equally important. It is therefore important to check the hashrate/power consumption ratio to make sure that there is a balance. It should not be in such a way that there is a low hash rate and a high power consumption as that will mean more losses in terms of electricity costs.

Normally Ethereum hashrate is measured in hashes per second. A typical Ethereum miner has a hashrate is 46 MH/s which is basically 4600 hashes per second.

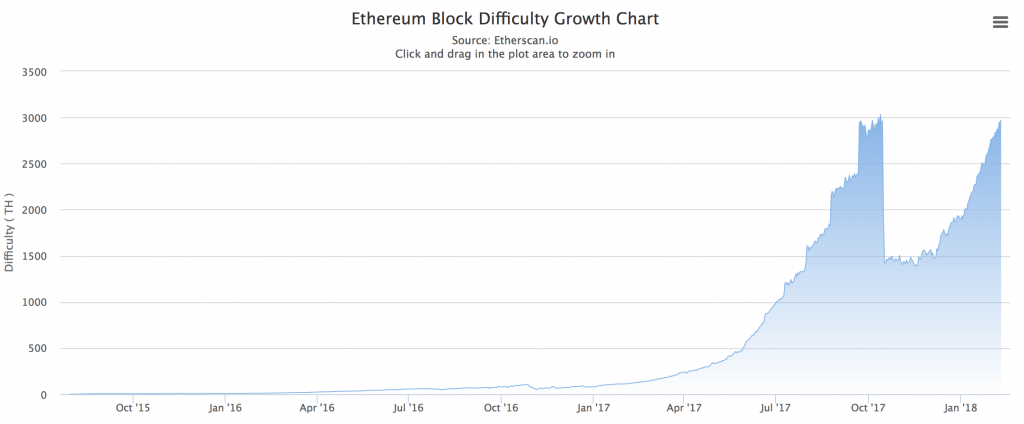

What is Ethereum Mining Difficulty?

Mining difficulty: Measurement of how difficult it is to solve the mathematical problem.

To improve the network, Ethereum plans to move from Proof of Work (PoW) to Proof of stake (PoS). Proof of Work is what is currently used, “work” being solving hashes.

Proof of work is whereby the computer decides who to award according to the kind of work that they have done. On the other hand, proof of stake is whereby one is awarded depending on the Ethereum shares they have.

With proof of stake, you can just buy Ethereum like a normal ICO then the rewards you get are on an annual basis depending on the amount of stake you have. Not only will you get dividends from the shares you have but you will also earn from the transaction fees for the coins that you have staked.

Even though a high hashrate and a low power consumption means higher profitability, which does not necessarily mean that it is the best mining hardware. Mining hardware’s comes at different costs even though they may both have a high hash rate. Sometimes it may be the best decision to buy a mining hardware that is cheaper and have several of them than have an expensive mining hardware then just buy one. For example if you have one mining hardware that costs $600 and another one that costs $150, it is better to go for the $150 one since you will have four of them which will mean more combined hashing power as compared to just buying one mining hardware for $600. There are many dynamics when it comes to profitability. To get a better estimate of projected earnings, you can use the Ethereum mining profitability calculator which can help you to know the profit ratio per day, per week, per month, or per year.

Comments 1

Looking at these new ASIC Antminer rigs that are hashing at 110 TH/s for bitcoin, would these work for ETH? Would they be hashing at the same rate or are they stifled by restrictions?